This site is intended for use by financial professionals only. Are you a financial professional?

Easy payment services directly to formal or professional care providers.

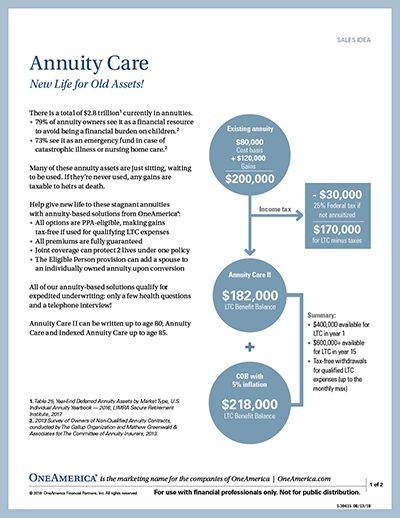

The Care Solutions annuity products include: Annuity Care, Annuity Care II and Indexed Annuity Care. Annuity Care is a single-premium deferred annuity with a higher credited rate of interest for qualifying long-term care expenses. When clients utilize their Annuity Care for qualifying LTC expenses, any money received is federal income-tax free as a result of the

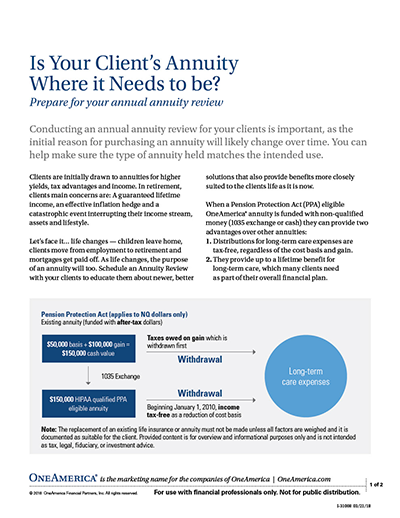

The Pension Protection Act, also known as Public Law 109-280, is a wide-ranging piece of legislation signed into law August 17, 2006. While much of the law deals with changes and reforms to pension governance, Section 844 of the act deals specifically with annuities, long-term care and tax advantages. As of January 1, 2010, cash value withdrawals from specific annuity contracts to pay for qualifying long-term care expenses or to pay qualifying long-term care insurance premiums, are no longer taxable income but considered as a reduction of cost basis. Benefit payments from long-term care insurance riders are also not taxable. This makes considering Annuity Care as part of your client’s long-term care protection a prudent financial strategy.

Most people purchase annuities because of the product’s guarantees, tax deferral and interest rate. All of these benefits remain true within our Annuity Care portfolio -- with the additional benefit of being able to use the annuity value for qualified long-term care expenses if needed. Key aspects of our annuity offerings include:

providing support, empathy and strategies for families navigating the need for long-term care. This means that your clients and their families have access to our Care Benefit Concierge, providing claims and bill support from day one.

Tailoring policies and align future care to their needs.

OneAmerica Financial and our asset-based long-term care strategies will be there when your client needs us most.

Use our Quick Quote Tool to explore Asset Care and Annuity Care rates and benefits..

*Quick Quote available for Asset Care and Annuity Care II only. May not reflect all available riders and may differ by state.

Below are a few client- and producer-facing materials to use as reference in your selling activities or to understand the flexibility of this product. Annuity Care offers countless ways to customize a strategy to meet clients’ needs.

NOTE: National version of all brochures shown here; may not be the acceptable version in every state. To ensure you are using the correct version of this brochure for your state/client’s state, please reach out to our Care Solutions Sales Desk at 844-833-5520.

Understanding how annuities can be used to help cover the cost of extended care needs

Understanding our Annuity Care product

Understanding our Annuity Care II product

An opportunity to review annuities on an annual basis to ensure their annuity strategy is up to date and identify opportunities to enhance tax efficiency

Help your clients understanding how their existing assets can be repurposed as part of their long-term care strategy

Ready to learn more? Reach out today and let’s see how we can work together to deliver for your clients.

This website page is designed for Financial Professionals. OneAmerica Financial is the marketing name for the companies of OneAmerica Financial. Products issued and underwritten by The State Life Insurance Company® (State Life), Indianapolis, IN, a OneAmerica Financial company that offers the Care Solutions product suite. Annuity Care and Annuity Care II form numbers: SA34, R508; SA35, ICC15 SA35, ICC15 R521 PPA ND, ICC15 R521 PPA, ICC15 R522 PPA. Indexed Annuity Care form numbers: ICC14 SA36, ICC14 R529 PPA, ICC14 R529, ICC14 R530 PPA, ICC14 R530, SA36, R529 PPA, R529, R530 PPA, R530. Not available in all states or may vary by state. All factors should be weighed before replacing an existing life insurance or annuity.